Basic Information

| Fiscal Year | April 1-March 31 | |

|---|---|---|

| General Meeting of Shareholders | June | |

| Record Date | General Meeting of Shareholders, Year-end Dividend |

March 31 |

| Interim Dividend | September 30 | |

| Trading Unit | 100 shares | |

| Shareholder Register Administrator or Special Account Management Institution | Sumitomo Mitsui Trust Bank, Limited | |

| Mailing Address (Telephone number) | Securities Agency Department, Sumitomo Mitsui Trust Bank, Limited 8-4 Izumi 2-chome, Suginami-ku, Tokyo 168-0063, Japan Tel: 0120-782-031 (Toll-free in Japan) Hours: 9:00 a.m. to 5:00 p.m. (M-F) |

|

| Shareholder Register Administrator | Securities Agency Department, Sumitomo Mitsui Trust Bank, Limited | |

| Stock Exchange Listing and its place of business | Tokyo (Securities code 4521) | |

| Method of Public Notice | Electronic public notices are posted on KAKEN’s website. (https://www.kaken.co.jp/english/). If an electronic public notice is not available due to unavoidable circumstances, a notice will be published in the Nihon Keizai Shimbun. | |

Share Information (As of September 30, 2023)

Major Shareholders (Top 10)

| Shareholder | Number of shares held (Thousands) | Shareholding ratio (%) |

|---|---|---|

| The Master Trust Bank of Japan, Ltd. (Trust Account) | 4,605 | 12.15 |

| Toray Industries, Inc. | 2,294 | 6.06 |

| The Norinchukin Bank | 1,843 | 4.86 |

| Mizuho Bank, Ltd. | 1,474 | 3.89 |

| NORTHERN TRUST CO. (AVFC) RE SILCHESTER INTERNATIONAL INVESTORS INTERNATIONAL VALUE EQUITY TRUST | 1,402 | 3.70 |

| Custody Bank of Japan, Ltd. (Trust Account) | 1,377 | 3.64 |

| KYORIN Pharmaceutical Co., Ltd. | 852 | 2.25 |

| NORTHERN TRUST CO. (AVFC) RE USL NON-TREATY CLIENTS ACCOUNT | 655 | 1.73 |

| STATE STREET BANK AND TRUST COMPANY 505103 | 653 | 1.72 |

| NORTHERN TRUST CO. (AVFC) RE U.S. TAX EXEMPTED PENSION FUNDS | 642 | 1.70 |

Note: The shareholding ratios are calculated after subtracting the number of treasury shares (8,041,487) from the total number of shares issued.

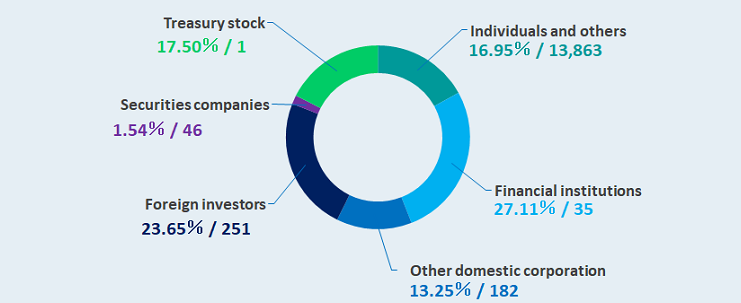

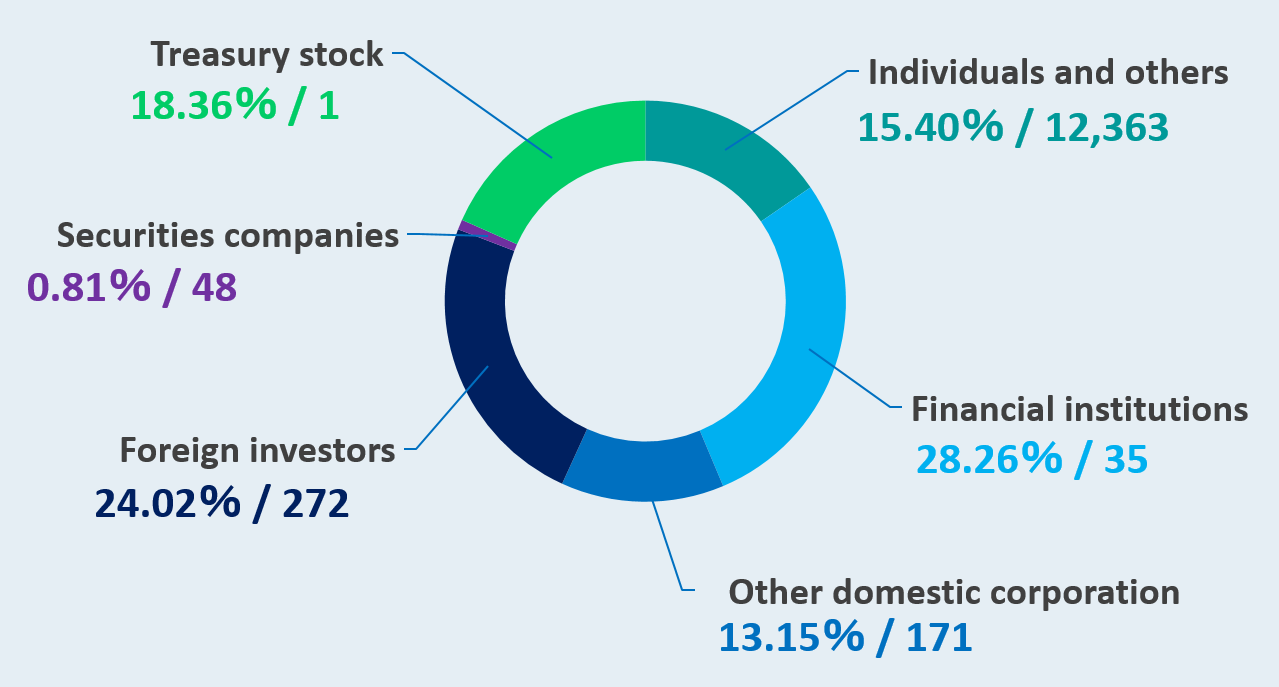

Shareholdings by Shareholder Type

Shareholder Returns

Dividend Policy

We view stable and continuous return of profits to shareholders as an important management goal.

Operating in the pharmaceutical industry entails large risks, requiring us to have a higher level of equity capital than companies in other industries. We employ a flexible dividend policy that sets cash dividends based on performance while maintaining a balance between returns to shareholders and strengthening equity capital. Our basic policy is to pay dividends from surplus twice a year as an interim dividend and a year-end dividend. The decision-making bodies are the Board of Directors for the interim dividend and the General Meeting of Shareholders for the year-end dividend.

Dividends

(Yen per share)

| Interim dividend | Year-end dividend | Annual dividend | |

|---|---|---|---|

| FY ended 3/2024 | 75.00 | 75.00 (forecast) | 150.00 (forecast) |

| FY ended 3/2023 | 75.00 | 75.00 | 150.00 |

| FY ended 3/2022 | 75.00 | 75.00 | 150.00 |

| FY ended 3/2021 | 75.00 | 75.00 | 150.00 |

| FY ended 3/2020 | 75.00 | 75.00 | 150.00 |